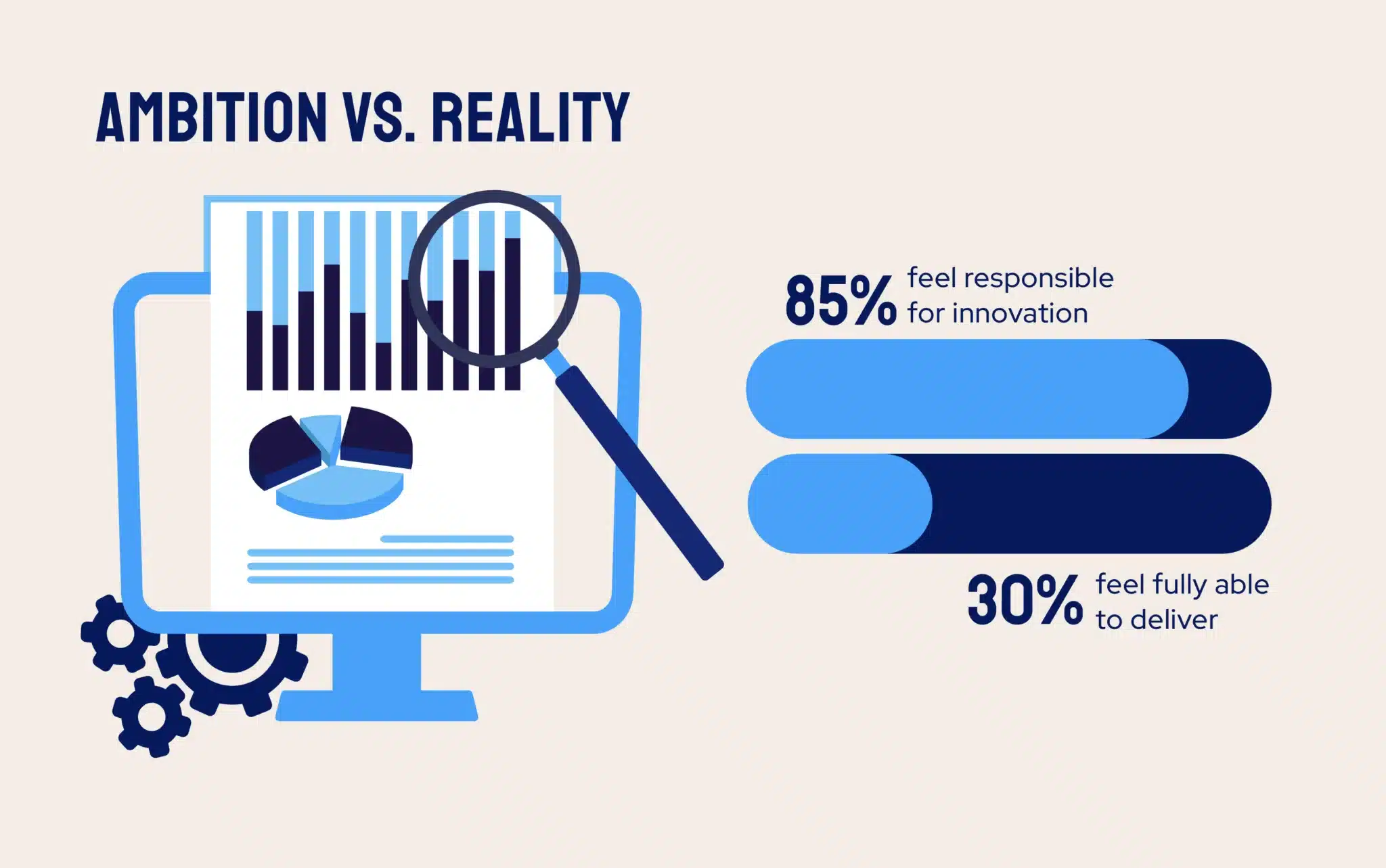

Raindrop Report Featured in Retail Dive: Only 27% of Procurement Leaders Feel Fully Able to Deliver, Raindrop Systems’ Research Finds

Raindrop NewsRaindrop Report Featured in Retail Dive: Only 27% of Procurement Leaders Feel Fully able to Deliver , Raindrop research says Retail ...

Raindrop Report Featured in Supply Chain Dive: 83% of Procurement and Finance Leaders Feel Accountable for Innovation

Raindrop NewsRaindrop Report Featured in Supply Chain Dive: 83% of Procurement & Finance Leaders Feel Accountable for innovation Supply Chain Dive ...

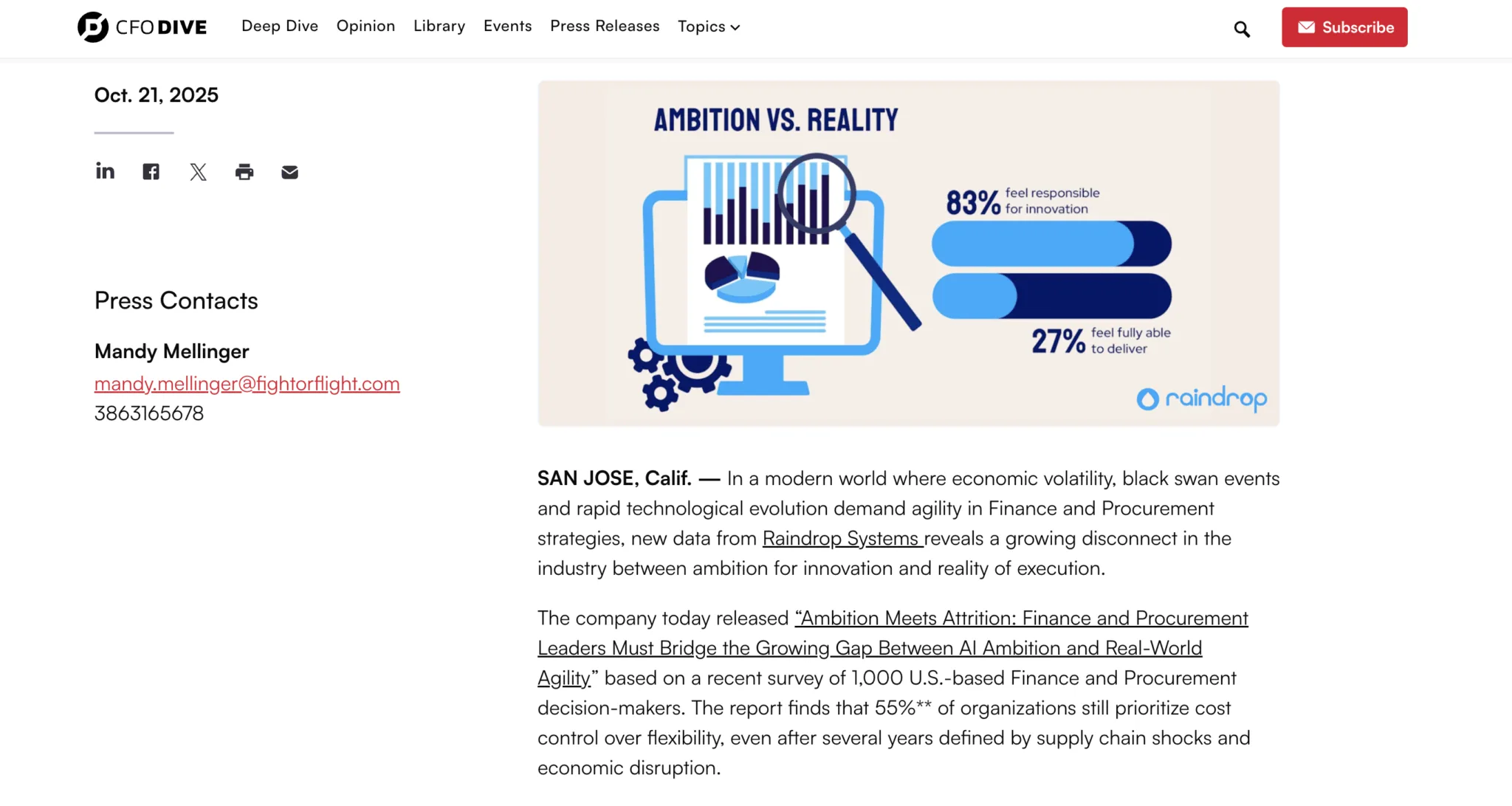

Raindrop Report Featured in CFO Dive: Survey Reveals 73% of Procurement Leaders Want More Flexibility in Their Strategies

Raindrop NewsRaindrop Report Featured in CFO Dive: Survey Reveals 73% Procurement Leaders want more flexibility in their strategies CFO Dive recently ...

Raindrop Report Featured in CPA Practice Advisor: 83% of Finance Leaders Feel Responsible for Innovation

Raindrop NewsRaindrop Report Featured in CPA Practice Advisor: 83% of finance leaders feel Responsible for innovation CPA Practice Advisor recently featured ...

Raindrop Report Featured in Supply & Demand Chain Executive: 83% of Procurement and Finance Leaders Feel Accountable for Innovation

Raindrop NewsRaindrop Report Featured in Supply & Demand Chain Executive: 83% of procurement and finance leaders feel accountable for innovation Supply ...

Raindrop Report Featured in Procurement Magazine: Procurement Leaders Feel Unable to Deliver Innovation

Raindrop NewsRaindrop Report Featured in procurement magazine: Procurement Leaders feel unable to deliver innovation Procurement Magazine recently featured insights from Raindrop ...

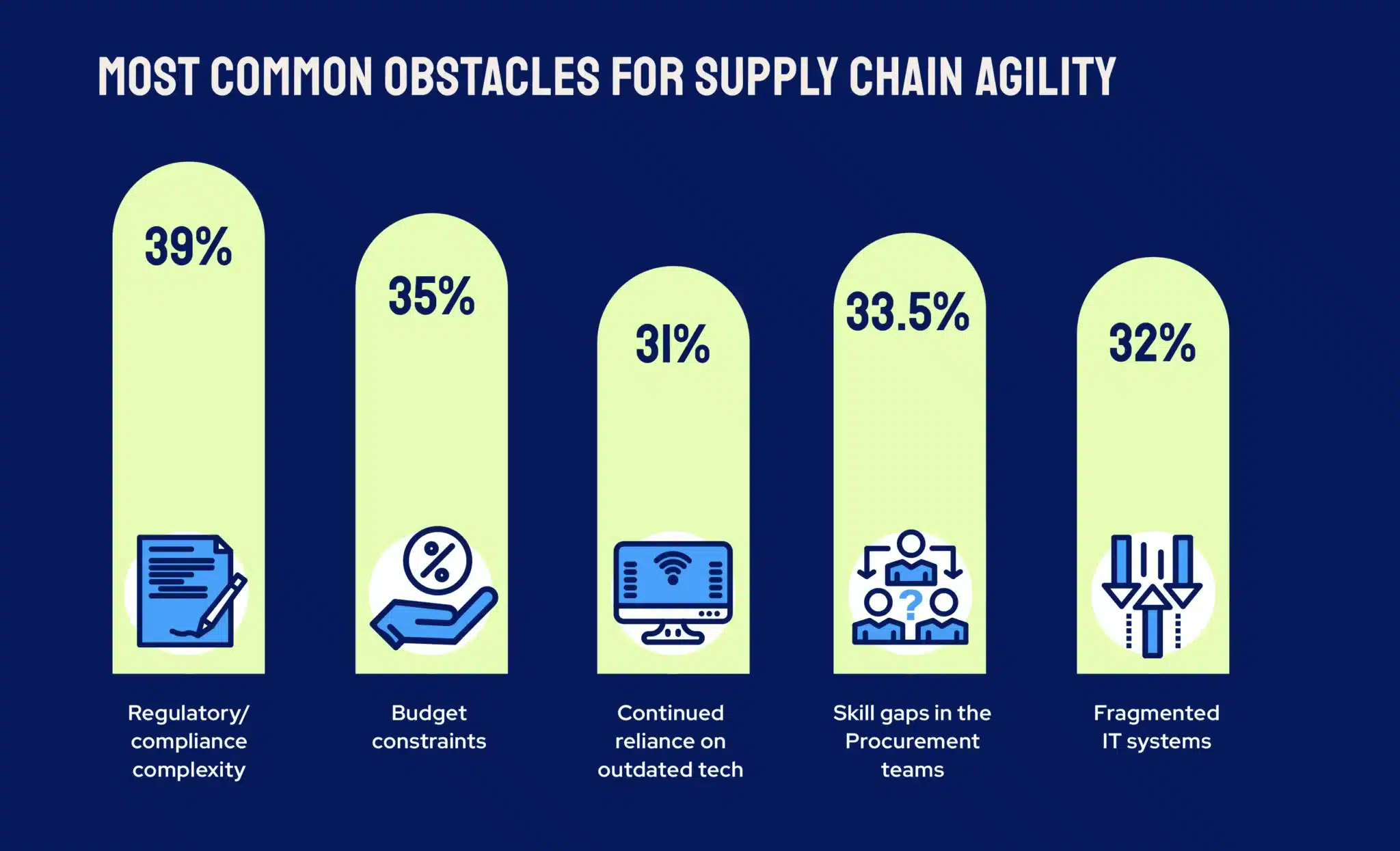

Raindrop Report Featured in Supply Chain 24/7: Most Procurement Leaders Want Innovation But Can’t Execute

Raindrop NewsRaindrop Report Featured in Supply Chain 24/7: Most Procurement Leaders Want Innovation but can't execute Supply Chain 24 ...

Raindrop Report Featured in Supply Chain Digital: Leaders Reveal Innovation and Execution Gap

Raindrop NewsRaindrop Report Featured in Supply Chain Digital: Leaders reveal innovation and execution gaps Supply Chain Digital recently featured insights from ...

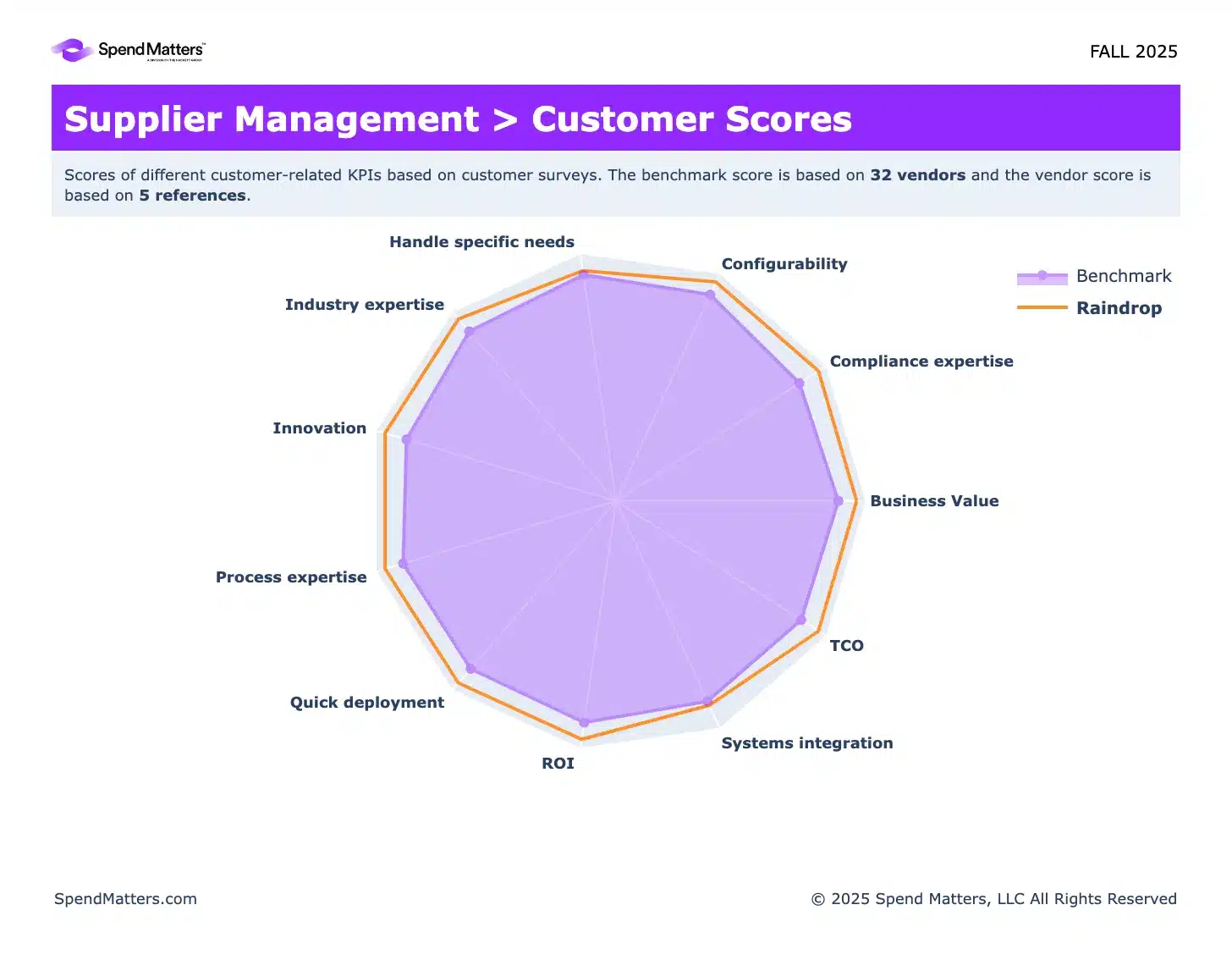

Raindrop Recognized as a Customer Favorite Across Four Categories in Fall 2025 Spend Matters SolutionMap; Expands into Four New Capabilities

Raindrop NewsRaindrop Recognized as a Customer Favorite Across Four Categories in Fall 2025 Spend Matters SolutionMap; Expands into Four New Capabilities ...

Raindrop Report Featured in Retail Dive: Retail Leaders Strive for Innovation Amid Shifting Market Demands

Raindrop NewsRaindrop Report Featured in Retail Dive : Retail Leaders Strive for Innovation Amid Shifting Market Demands Retail Dive recently featured insights ...

Raindrop Report Featured in Supply Chain Dive: Innovation and Agility Top Priorities for 2025

Raindrop NewsRaindrop Report Featured in Supply Chain Dive: Innovation and Agility Top Priorities for 2025 Supply Chain Dive recently featured findings ...

CFO Dive Highlights Raindrop Research: 83% of Finance and Procurement Leaders Feel Accountable for Innovation

Raindrop Newsraindrop featured in cfo dive for new research report Raindrop surveyed 1,000 Finance and Procurement decision-makers across the ...